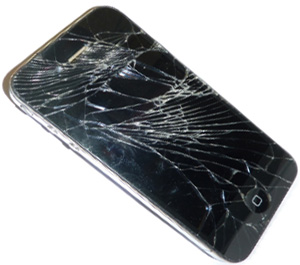

Are you paying a monthly fee to your cell carrier to cover repairs to your phone should something happen to it? If you are, you’re probably paying way too much for what could amount to very little coverage.

Are you paying a monthly fee to your cell carrier to cover repairs to your phone should something happen to it? If you are, you’re probably paying way too much for what could amount to very little coverage.

Depending on the carrier and phone, you could be paying upwards of $15 per month for a plan that has a whopping $200 deductible!

In my opinion, carrier insurance (AKA an extended warranty) is rarely a good deal, even when it does actually “pay off”. Which brings me to my next point…

What will your carrier’s insurance actually cover? Depending on the plan, probably not as much as you think. Some plans don’t include normal wear and tear or certain types of accidental damage. And even if they do, they still require you to meet a sky-high deductible before they’ll pay out anything at all.

If you happen to be the clumsy type like me, you might want to consider a much better alternative to the pricey warranty offered by your cell carrier.

My personal recommendation is to skip the insurance offered by your cell carrier and “self-insure” by depositing the amount you’d pay for the warranty every month into a savings account. Chances are you’ll never have to use your “insurance” money, but if you do you’ll at least be assured of having something set aside to spend on phone repairs.

Another option is third-party insurance. A great company called Square Trade offers third-party extended warranty coverage on mobile devices that is not only less expensive than the plans offered by your carrier, but provide better coverage as well. And the deductible is typically a LOT lower. If you really feel that you need a warranty for your phone, I suggest giving Square Trade a good look.

Bottom line: The typical insurance plan offered by the cell carriers is over-priced, provides inadequate coverage, and comes with a sky-high deductible. I recommend that you either skip the warranty altogether and “self-insure” or opt for a better warranty deal through Square Trade.

Bonus tip: This post explains why extended warranties are usually bad deals in general, especially on computers and other electronic devices.

Do you have a tech question of your own for Rick? Click here and send it in!

Like this tip? If so, I invite you to share it with your friends. Just click one of the handy social media sharing buttons below.